Award-winning PDF software

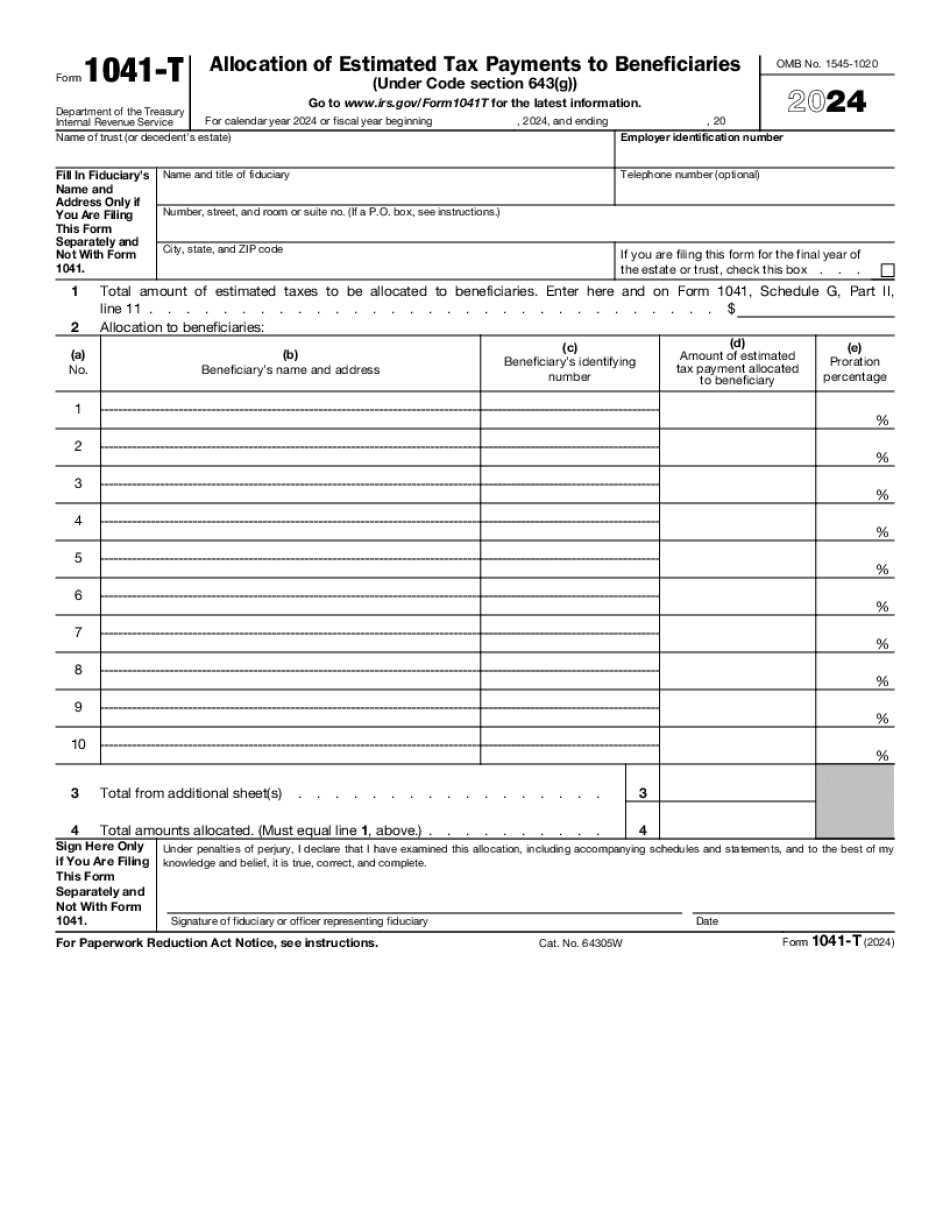

Form 1041-T for Moreno Valley California: What You Should Know

Form 1041-1 is just Form 1041 that will be accepted by the IRS as a substitute. See the Form 1041-3, Nonresident Trust, Fiduciary and Taxation, to get ready for you upcoming annual return. Franchises | FT.ca.gov Form 1-S, General (Including Wages, Wages, and Commission) — The IRS is changing the form it sends to franchised restaurants to make it easier to complete. We urge you to check the Form 1-S for Franchise or Subcontractor that you are using to file your Form W-2. We will cover those later this year. Tax Information For Restaurants — From 2018 Form 1095-C, Business and Professional Corporation — Form 1095-C allows a business to deduct business expenses, such as office rent and the cost of insurance. The form can be filed with the annual 1040 form. The Form 1095-C will only be processed for the tax year in which it is filed. Form 1038, Quarterly (Second-Quarter) Wages, Wages, and Commission — Form W-2 Instructions Wages, Wages, And Commission — WAGES: Wages are a deduction; they include wages paid for services that are performed by employees as well as wages paid to self-employed persons. These wages are reported to your employer as gross wages on Form W-2. Payroll Taxes — What You Need to Know Form W-2 — Where Did Your Wages Come From? Tax Return and IRS Tax Forms Income Taxes — For 2025 For the first time, many countries are requiring online filing of tax returns. Here are a few examples. You can also find an IRS guide on the IRS website to help you with tax forms and filing. Annual income tax is due on April 30 of each year unless you qualify for a special tax treatment. You should have your annual return ready before April 15 of your tax year. You can either file electronically using a software program, an electronic filing service, or use paper tax forms. A tax technician can help you in preparing your tax forms using an electronic filing service. You can also file online using TurboT ax (at no charge to you), Google Finance (from your own account), or a third-party software program. You can print and file your 2025 tax return using your electronic service of choice.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1041-T for Moreno Valley California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1041-T for Moreno Valley California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1041-T for Moreno Valley California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1041-T for Moreno Valley California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.