Award-winning PDF software

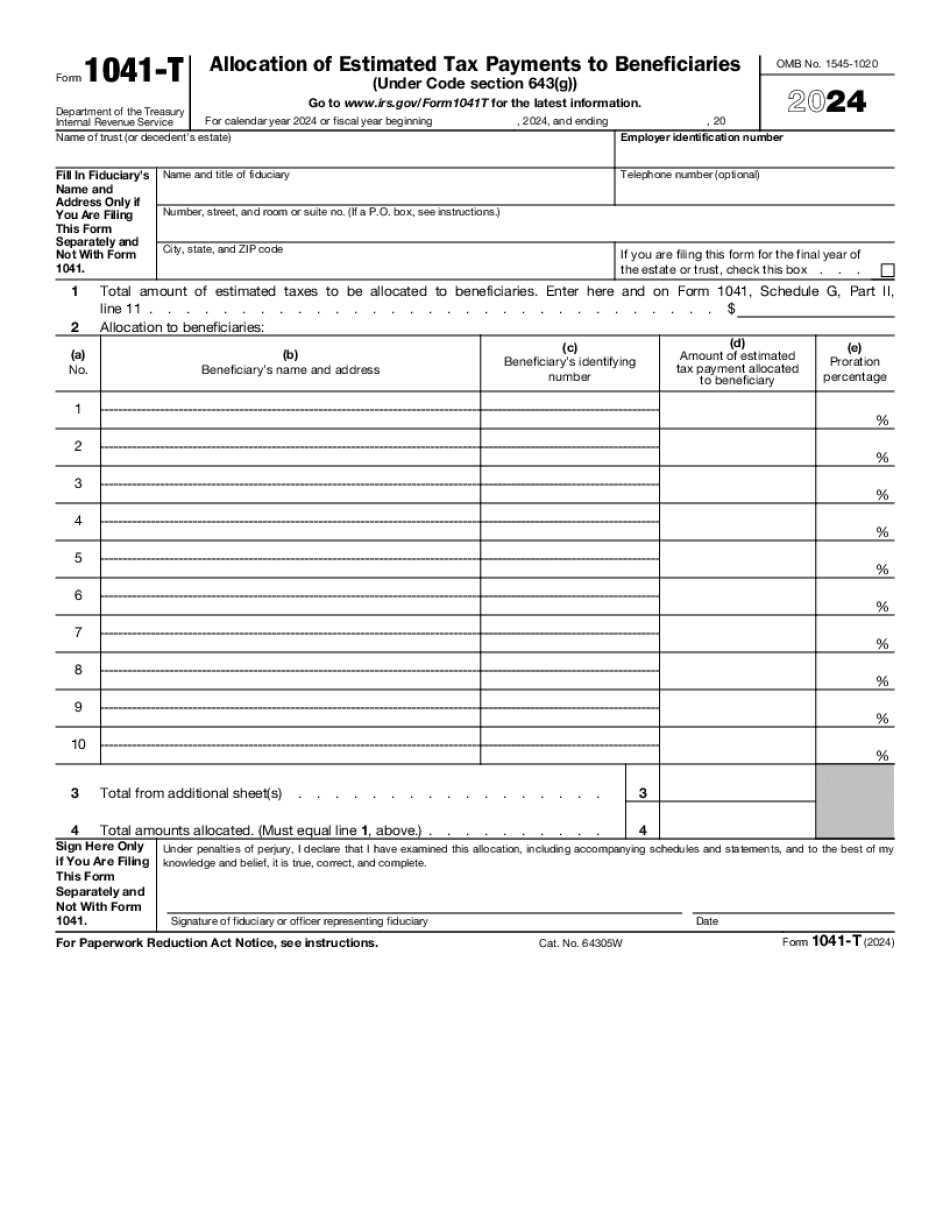

Printable Form 1041-T Santa Clarita California: What You Should Know

To determine the income you must pay, you could use Form 1040-EZ, U.S. Individual Income tax return, or Form 1040-ES, U.S. Individual Income tax return. Form 1040-EZ — U.S. Individual Income tax return, which would be filed to claim exemptions. Form 1040-ES — U.S. Individual Income tax return, which would be filed to claim exemptions. We have several IRS guides available for estate law that will Help You To calculate The Adjusted Gross Estate The Form 8332, Estate and Gift Tax Return The form is mailed to you on the day after you file. You must file it by the 1st day following the death of an estate. Form 8332 — Estate and Gift tax Return is a tax return used by the executor or administrator of an estate. It includes detailed information about the assets of the estate at the time of the death, which includes: • Property, shares, interests (whether vested or invested, or in the case of a decedent, whether held for business or speculative purposes), and other interests of the decedent's estate, as well as items (not including real estate) not held by the decedent. (For examples of itemized information that can go into the report, see The executor or administrator must calculate the total value of itemized information (known as adjusted gross estate (AG)). Form 8332 — Estate and Gift Tax Return is available on IRS.gov. You can download by clicking here. Calculating The Gross Value of Items Held for Consumable Uses The Form 1116, Deceased Beneficiary's Gift Tax Return Itemization is the first step in calculating the total value of the estate for purposes of computing the AG. Itemization includes identifying all items of value given or received to a person during a period of life when the person has “no present expectation of benefit,” which means an heir would normally be unable to recognize any net gain, and the value of those items of value. An executor or administrator must file an itemized report by the 1st day following the death of an estate, unless it follows the reporting requirements in section 523(d).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 1041-T Santa Clarita California, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 1041-T Santa Clarita California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 1041-T Santa Clarita California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 1041-T Santa Clarita California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.