Award-winning PDF software

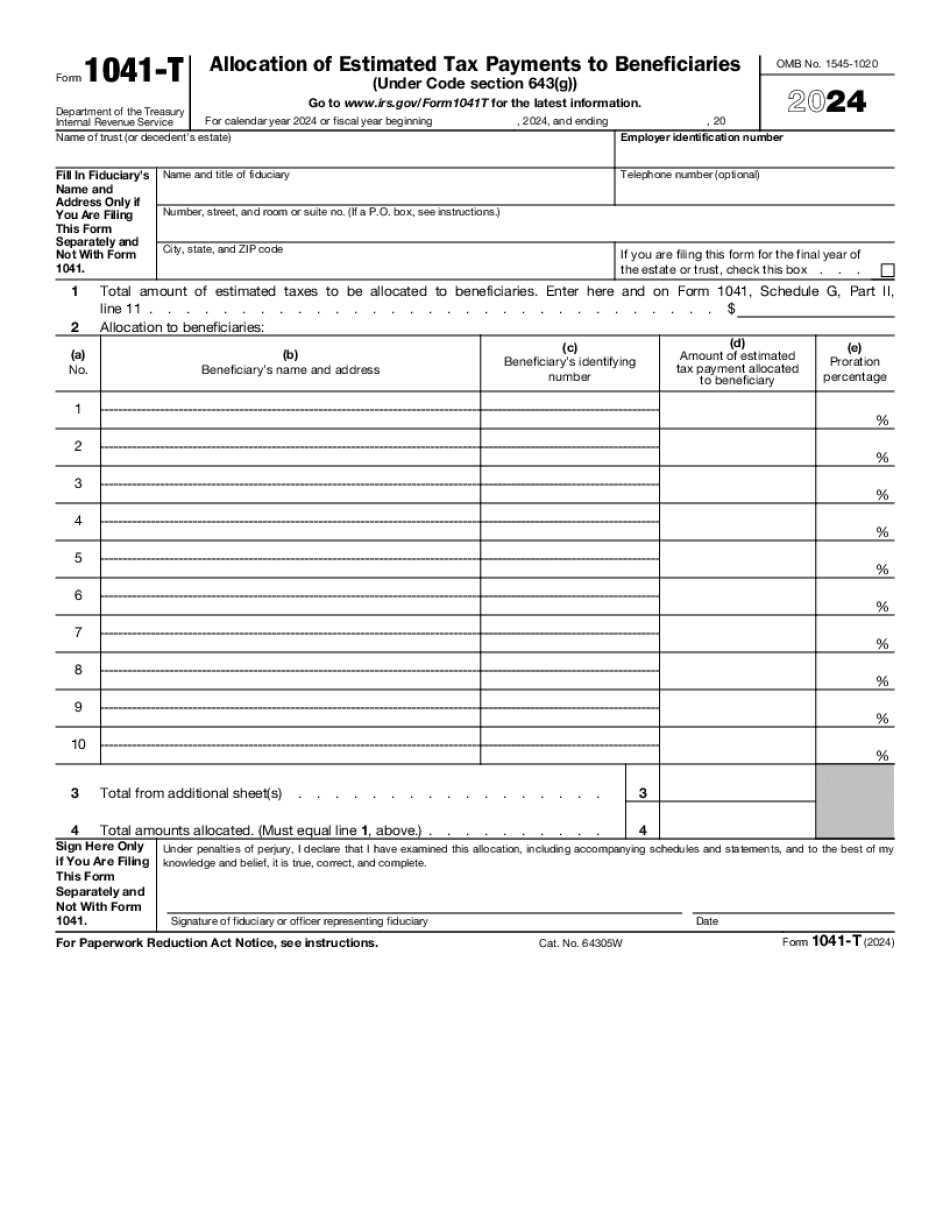

Printable Form 1041-T Sunnyvale California: What You Should Know

The Form 1041 form is Form 1041 does not need to be filed by fiduciaries. In addition, no IRS filing obligations exist for the payment of interest or dividends on the interest or investment gains (interest income as defined in Section 7201) earned by any trust. As a fiduciary, a trust must file a Form 1040. Form 1041 for an Estate or a Trust — Explanation A Form 1041 is a self-contained financial statement for a trust, estate, or other organization created before December 30, 2010, and which has one or more financial assets (asset or estate). A Form 1041 is a self-contained financial statement with information from which it is possible to compute the income, deductions, and credits received and paid by a trust, an estate, an annuity contract, or other organization that uses a U.S. federal income tax return or that would be subject to a U.S. income tax without a U.S. federal income tax return because of exemption. A beneficiary's financial interests are computed by first computing the beneficiary's distribute estate. Then the beneficiary's distribute estate is reduced by any amount paid in cash (to the extent that the amount represented by the cash exceeds 100% of the value of the beneficiary's interest, which is zero if the beneficiary is a trust) or in property exchanged for cash (or property with an adjusted cost basis, not to include the fair market value of the property to the beneficiary less the cost basis). The result is reduced by any amount which exceeds a percentage of the beneficiary's income for all periods presented—which percentage is zero, if the beneficiary is a trust, if the beneficiary is not a trust, and if the beneficiary is a qualified fund or plan described in the definition of qualified fund in section 401(a)(29) or a qualified retirement plan. If this is the first year during which the beneficiary is a qualified fund or plan, the percentage to be used is 35%. However, if more than one year passes between filing the financial statement and its due date, the percentage used for the calendar year in which the financial statement is due (but not for any subsequent year) may be 30%. The financial statement is due on or before the 15th day of the month following the close of the tax year or on the 15th day of the month before the close of the tax year.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 1041-T Sunnyvale California, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 1041-T Sunnyvale California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 1041-T Sunnyvale California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 1041-T Sunnyvale California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.