Award-winning PDF software

Form 1041-T Irvine California: What You Should Know

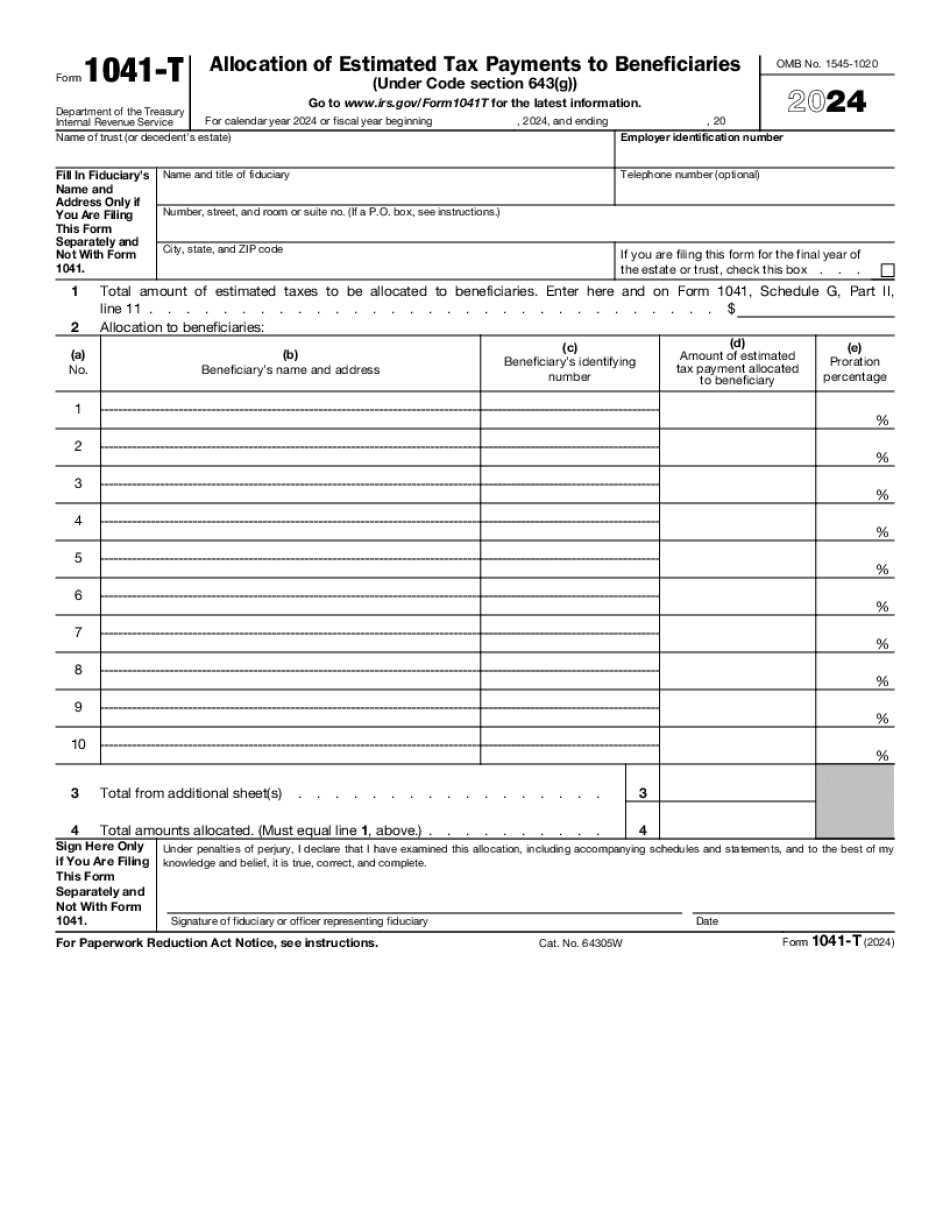

When a trust or estate is to file a tax return, the trust or the estate will be required to complete a Form 1041. The Form 1041 contains many of the same information as an individual income tax return. However, Form 1041 contains many additional provisions concerning the allocation of estimated tax payments and the manner of payment. To make sure you determine your tax liability for the remainder of your life, it is important that you understand your obligations when it comes to the allocation of your estimated taxes. The allocation process may include payment arrangements with the Internal Revenue Service, or the trustee of an estate may be responsible for making the allocation if the deceased person has not been living at the time of death. As discussed in more detail below in the section entitled “Assignment of Property To a Trust or Estates,” an estate or trust is, by definition, both a “prospective beneficiary” of its beneficiaries. In order for a trust or estate to pay an estimated tax, the beneficiaries of the trust or estate must determine the amount of tax that is to be deducted from the assets. While the trust or estate has a right to determine these amounts, the beneficiaries have not completed an income tax return. Because the beneficiaries do not have to file an income tax return, they do not know their gross income or estimated taxes. Although the beneficiaries do not have an ability to pay their estimated taxes, they have the right to have money left in the trust or estate after the tax rate is deducted, if the trust or estate is a qualified or nondeductible IRA and to retain all other income and earnings in the trust. Assignment of Property to a Trust or Estates is Not Required As long as the beneficiary of an IRA, a 401(k), a qualifying small business loan or any other qualified or nondeductible retirement plan has elected the allocation process described above, the trust or estate should not be required to assign income or tax-deductible investment earnings from the trust to a different IRA, 401(k), or other qualified or nondeductible retirement plan. Any amount transferred from the trust or estate should be used to pay the estimated tax and all the following requirements must be met: If the assets are a qualified IRA or a qualified employee pension (preferred stock), the trust or estate should not be required to transfer income in excess of the income tax amount described in the Trust Agreement (i.e., 50% of the trustee's salary).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1041-T Irvine California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1041-T Irvine California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1041-T Irvine California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1041-T Irvine California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.