Hello, I'm Rocco Beatrice, the managing director for Estate Street Partners Ultra Trust. A lot of times, I get asked, "What exactly is the role of a beneficiary in a particular trust, like an Ultra Trust?" Well, a beneficiary is someone who will enjoy the assets of the trust. Now, when does the distribution begin? That depends on the contract written. For example, if you have a 65-year-old, then distributions will come to him. If he dies, it goes to the children. When do the children get the distributions? Again, the contract will specify exactly when these distributions are going to occur, and how much. For example, if you have younger children, you may want to put some incentives in place. You don't want the beneficiary to be able to take all the money and spend it irresponsibly. So, it's important to put in some incentives to make their lives better. Examples of incentives could be providing financing for their education, supporting their home purchase, or even funding their business ventures. The trustee would evaluate the potential financial plan of the beneficiaries to determine if it makes sense. If it does, the trustee can become a silent partner, fund the venture, or take on other roles to support the beneficiary's success. If the beneficiary's sport or any other activity is not specifically mentioned in the trust, the trustee will assess the success plan of the beneficiary's spouse. If it's reasonable, the trust can act as a bank or venture partner. However, the role of the beneficiary in all this is to follow the instructions of the trust document. Usually, the beneficiary has a copy of the trust document. There are also provisions in place to address any attempts by a beneficiary to attack or invalidate the trust. In such cases,...

Award-winning PDF software

Backup withholding trust beneficiary Form: What You Should Know

If you are not a U.S. person (and are not a foreign entity) If you are not a U.S. person, but would pass through your backup withholding to the beneficiaries of the trust or estate that holds the decedent's estate, please add the amount of backup withholding in Schedule D to your tax return for the year in which your trust or estate holds the decedent's estate, in which case it would go to line 34, “Additional taxes, including income tax,” of your Form 1040, Form 1040A or Form 1040EZ. You will also enter the amount of backup withholding from this Schedule D on line 35 of your decedent's estate tax return.

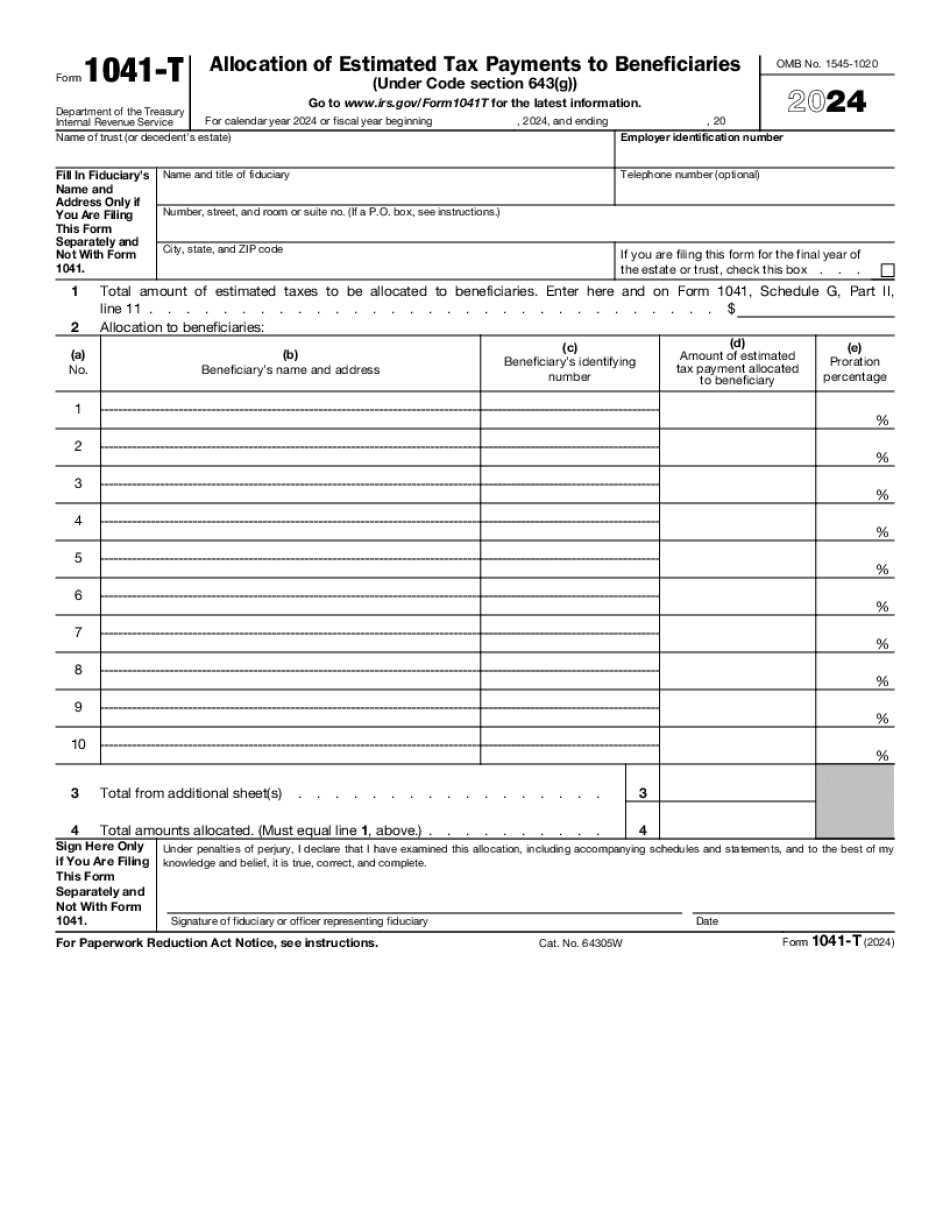

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1041-T, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1041-T online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1041-T by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1041-T from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Backup withholding trust beneficiary